Content

ERS continually evaluates the overall use of the program to ensure employees and retirees find the offers helpful. It reduces the expenses or cash outflow of the company, but it could not be considered the revenues under the accounting principle.

Another disadvantage is that giving up purchase discounts on inventory raises your cost of goods sold and lowers your gross margins. This makes it harder to lower prices against the competition and still operate at a profit. A purchase discount is a reduction in price that a supplier or wholesaler offers to a retailer or store. The supplier may receive the purchase discount for different reasons. The most common reasons for a purchase discount include buying within a certain time frame and buying items in bulk. Purchase discounts mean that retailers don’t spend as much to get a product into their selling facility or warehouse.

Referral promo code

However, modern accounting theory holds that income is not derived from a purchase but rather from a sale or an exchange and that purchase discounts are reductions in the cost of whatever was purchased. The true cost of the goods or services is the net amount actually paid for them. Treating purchase discounts as income would result in an overstatement of costs to the extent of the discount. Purchase discount is an offer from the supplier to the purchaser, to reduce the payment amount if the payment is made within a certain period of time. For example, a purchaser bought a $100 item, with a purchase discount term 3/10, net 30.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

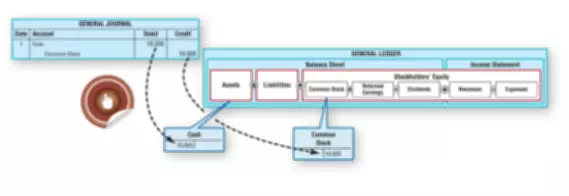

- Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount.

- A buyer debits Accounts Payable if the original purchase was made on credit and the payment has not yet been made to a seller.

- Often, these sales are used at the end of a month or quarter to increase revenues to meet business goals.

- Automatic discounts apply to every eligible cart, and customers see them on the cart page before they start the checkout process.

If he pays half the amount In accounting, gross method and net method are used to record transactions of this kind. Under the gross method, the total cost of purchases are credited to accounts payable first, and discounts realized later if the payments were made in time. And if the payments are not made in time, an anti-revenue account name https://www.bookstime.com/ lost is debited to record the loss. If the business fails to take the discount, the entry to record the payment will be straight forward. Accounts payable is debited, and Cash is credited for $100, the full invoice price. Like the gross method of recording sales discounts, the gross method of recording purchase discounts is very common.

Accounting Topics

This contact form is only for website help or website suggestions. If you have questions or comments regarding a published document please contact the publishing agency. Comments or questions about document content can not be answered by OFR staff. The Office of the Federal Register publishes documents on behalf of Federal agencies but does not have any authority over their programs. We recommend you directly contact the agency responsible for the content in question. Based in Greenville SC, Eric Bank has been writing business-related articles since 1985.

Why are purchase discounts offered?

Retailers mark down their products when they want to get rid of the old stock and replace them with new inventory. They wanted to attract more customers with their seemingly affordable prices. One of the most important reasons that discounts are offered is to generate consumer surplus.

Customers may stop responding to sales discounts if they receive them too often because the discounts become “normal” instead of a privilege. Even if customers remain responsive over time, they eventually may question why prices have gone back up once the retailer stops offering the sales discounts.